Bitcoin halving is a crucial event in the world of cryptocurrencies that has a significant impact on investors and miners alike. It’s a process built into the Bitcoin protocol that occurs approximately every four years. During this event, the reward for mining new Bitcoin blocks is cut in half. This mechanism was introduced by Bitcoin’s creator, Satoshi Nakamoto, to control the supply of Bitcoin and maintain its scarcity, similar to precious metals like gold.

According to FintechZoom.com Bitcoin Halving, the prmary purpose of this event is to regulate the rate at which new Bitcoins are created and released into circulation.By reducing the mining reward, the halving helps keep Bitcoin’s value stable over time and ensures it remains a deflationary asset. This is in stark contrast to fiat currencies, where govrnments or cntral banks can print more money at their discretion, potentially leading to inflation.

The BitCoin Halving event took place on April 19, 2024. This event had reduce the reward for mining, new Bitcoin blocks from 6.25 BTC to 3.125 BTC, impacting the rate at which new Bitcoins are introduced into circulation Cointelegraph, Finbold.

1. Understanding Bitcoin Halving: A Key Mechanism for Crypto Investors

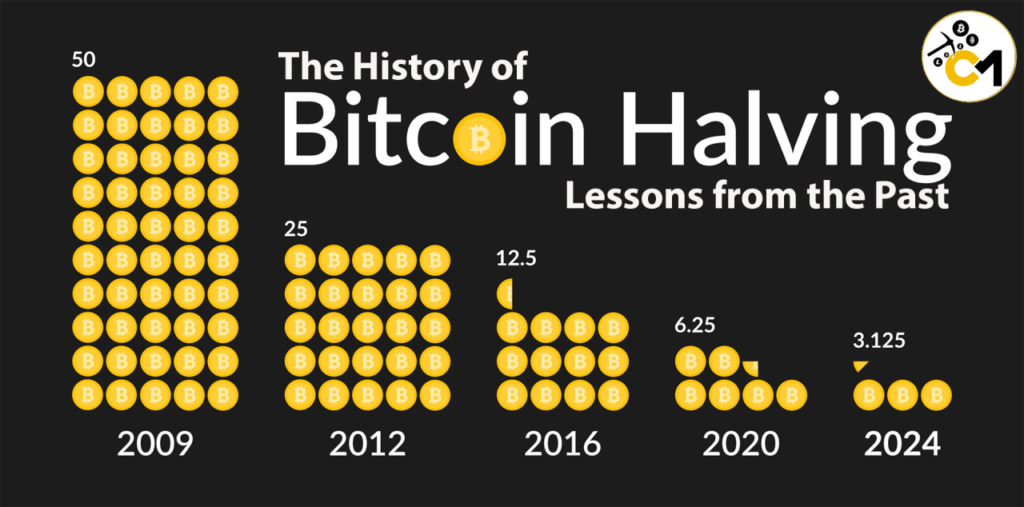

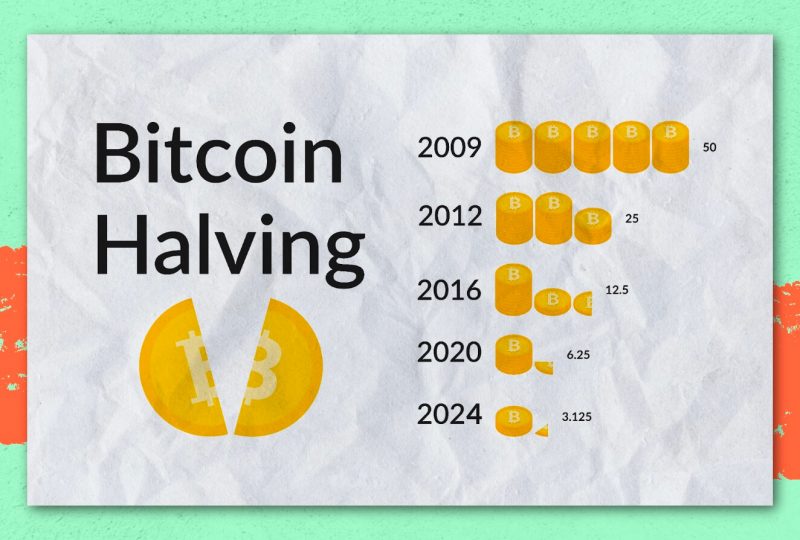

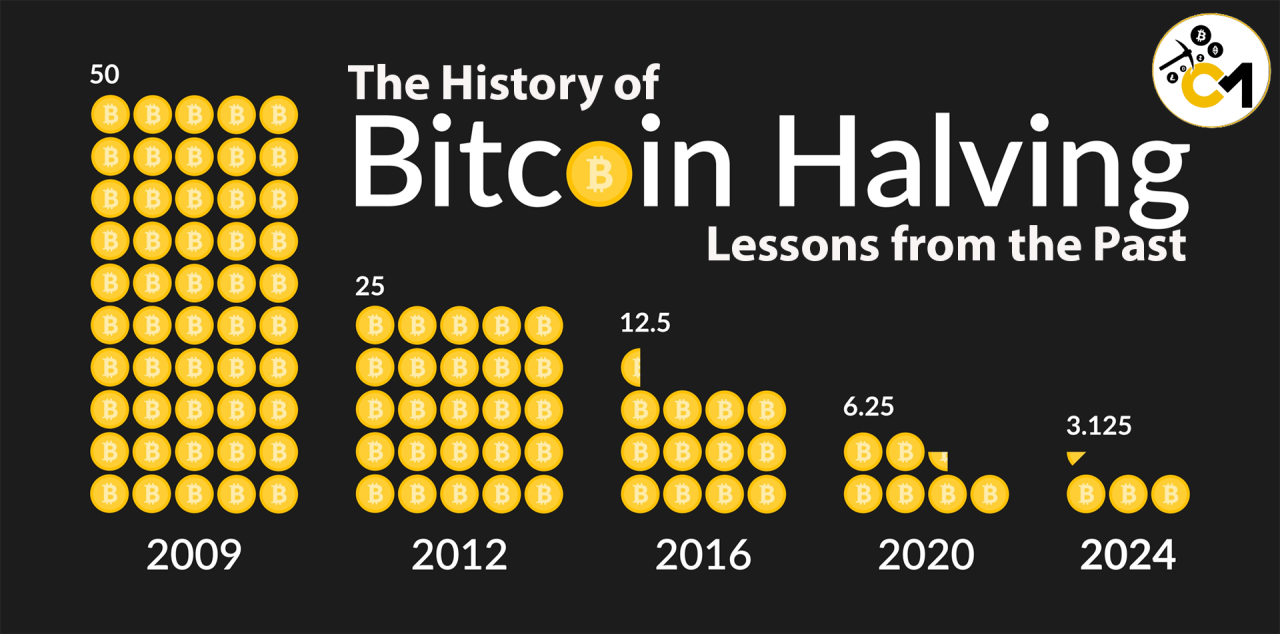

Bitcoin halving is a completely unique system embedded inside the Bitcoin blockchain protocol, happening about each 4 years, or every 210,000 blocks. This technique cuts the block praise miners receive with the aid of half, decreasing the brand new Bitcoin supply charge and impacting its shortage. The preliminary block reward started out at 50 BTC and has on the grounds that gone via multiple halvings:

- 2009: Block praise started out at 50 BTC.

- 2012: First halving decreased the praise to twenty-five BTC.

- 2016: Second halving reduced it further to 12.Five BTC.

- 2020: Third halving added it down to 6.25 BTC.

- 2024 (upcoming): Expected to lessen the reward to a few.125 BTC.

The primary intent of Bitcoin halving is to manipulate inflation and create shortage. This shape, just like treasured metals like gold, makes Bitcoin a perfect save of value.

Table of Contents

2. The Economics of Bitcoin Halving: Supply and Demand Dynamics

Bitcoin’s constant deliver of 21 million cash, mixed with halving occasions, introduces a deflationary mechanism. Each halving slows the influx of recent cash, affecting supply:

- Reduced Supply: By lowering the block rewards, the rate of Bitcoin manufacturing decreases. This can lead to a discounted wide variety of Bitcoins available on exchanges, particularly if call for stays solid or increases.

- Increased Scarcity: As Bitcoin becomes scarcer, buyers anticipate a rise in call for, hoping to benefit from a “supply surprise” impact.

This phenomenon has historically brought about vast price will increase following each halving. For example, the 2020 halving preceded Bitcoin’s rise from around $9,000 to over $60,000 inside a year.

3. Past Bitcoin Halvings: Price Trends and Market Impacts

Examining historic halving activities presents insights into ability price movements and market influences:

- First Halving (2012): Bitcoin’s charge rose from $12 to $1,000 over the subsequent year.

- Second Halving (2016): Bitcoin surged from round $600 to nearly $20,000 by using December 2017.

- Third Halving (2020): Bitcoin’s value grew from $9,000 to over $60,000 in 2021.

Real-World Investor Insights: Experienced traders frequently use halvings to strategize access and exit factors. Timing the marketplace based on historical styles has helped many maximize returns.

4. 2024 Bitcoin Halving: What Can Investors Expect?

The 2024 Bitcoin halving is predicted to have nuanced results, given the maturity of the cryptocurrency market and macroeconomic elements:

- Increasing Institutional Investment: In recent years, institutional traders, together with large banks and hedge price range, have different into Bitcoin, adding stability and liquidity to the market.

- Potential Regulatory Impact: With improved global regulation of digital property, investor sentiment and marketplace volatility may be motivated by way of new rules in foremost economies like the U.S. And the EU.

- Technology Advancements: Layer-2 answers like the Lightning Network, designed to enhance transaction velocity and decrease charges, ought to make Bitcoin extra handy, potentially influencing demand submit-halving.

5. Mining Economics Post-Halving: What Happens to Miners?

Bitcoin miners are important to the community, verifying transactions and preserving protection. However, each halving occasion slashes their rewards, affecting profitability. In response:

- Mining Consolidation: The lower in rewards pressures smaller miners to go out, probably leading to a concentration of mining energy among large operations with green hardware.

- Increased Transaction Fees: As block rewards drop, miners may additionally rely greater on transaction charges, which could affect the price of Bitcoin transactions over time.

Real-World Data: The common transaction price during durations of high call for, inclusive of put up-2020 halving, rose sharply. In 2021, Bitcoin’s transaction fees in short handed $60.

6. Expert Insights: How Financial Markets and Bitcoin Halving Intersect

To recognize how Bitcoin halvings effect financial markets, do not forget insights from crypto analysts and economists:

- Macro Influences: “Bitcoin’s price proposition as digital gold becomes more applicable in excessive inflation and economic uncertainty,” says crypto analyst Linda Zhang.

- Market Volatility: Senior economist Alex Green notes, “Expect improved volatility across the halving, as market individuals think again Bitcoin’s charge in reaction to modifications in deliver.”

7. Risks and Considerations for Crypto Investors

Like any funding, Bitcoin carries risks, specifically round halving events:

- Market Volatility: Halvings have historically triggered brief-time period charge spikes, observed by using corrections. New investors should be careful of speedy fluctuations.

- Network Security: As rewards lower, if transaction expenses do not compensate, miners may depart the network, probably impacting security.

Risk Management Tip: Diversify crypto holdings, incorporate dollar-value averaging, and recollect a balanced portfolio with different belongings to mitigate risks.

8. Engagement and Actionability for Investors

Investors trying to capitalize on Bitcoin halving should attention on actionable steps:

- Timing Investments: Study historical halving styles however avoid hypothesis via dollar-fee averaging investments to limit market timing dangers.

- Portfolio Diversification: Including belongings like Ethereum or stablecoins can assist stability the volatility in a crypto portfolio.

10. Conclusion: Bitcoin Halving in 2024 and Beyond

The 2024 Bitcoin halving holds huge implications for the cryptocurrency marketplace, from miner profitability to ability charge surges. As institutional interest grows and guidelines evolve, Bitcoin’s position as a shop of price stays robust. For crypto investors, expertise the dynamics of halving occasions can resource in making knowledgeable, strategic choices.